Posted On: February 14, 2024 by Prevail Bank in: Banking / Money Management

Making New Year's Resolutions?

As you embark on the exciting journey of self-improvement in 2024, consider your financial health. Your credit score defines your financial health and future well-being. Your obtainment of better housing, employment opportunities, and an affordable mortgage and car loan are on the line. A low credit score typically means higher upfront costs, interest rates, and monthly fees.

As an example:

For a $20,000 used car loan, with a five-year term:

A person with a high credit score could expect to pay approximately $371 every month VERSUS roughly $502 for a buyer with a lower credit score.

The buyer with better credit would pay about $2,235 in interest over those five years, while the buyer with lesser credit would pay around $10,147 --- That’s $7,911 MORE for the same car!

Seriously, who has that kind of extra money laying around?! And to make matters worse, in most states, bad credit also means higher car insurance rates too! It’s like pouring salt on an open wound. It just keeps getting worse.

| Car Payment Calculator | |||||

|---|---|---|---|---|---|

| Information provided is for educational purposes only. Accuracy of results below can not be guaranteed. | |||||

| Credit Score | Average APR, Used Car** | Amount Borrowed | Payment Length (Term) | Estimated Monthly Payment* | Total Interest Paid* |

| 760+ | 3.49% | ||||

| 700-760 | 4.25% | $20,000 | 60 months | $370.59 | $2,235.47 |

| 650-700 | 6.50% | ||||

| 600-650 | 10.75% | ||||

| 550-600 | 17.50% | $20,000 | 60 months | $502.44 | $10,146.66 |

| Below 550 | 22.00% | ||||

| *https://www.experian.com/blogs/ask-experian/car-payment-calculator/ | |||||

| **APR Source (Jan 1, 2024): https://www.withclutch.com/faq/what-is-the-average-interest-rate-on-an-auto-loan-with-700-credit | |||||

| APR = Annual Percentage Rate | |||||

So, how can you get ahead? How can you avoid paying these higher interest rates?

By improving your credit score.

What is a credit score?

Your credit score (commonly called a FICO Score) is often the determining factor when a loan, interest rate, or credit card application is being evaluated. FICO Scores can range from 300 at the low end to 850 at the high end.

Credit scores are maintained by the national credit bureaus (Equifax, Experian, and TransUnion) and include debt like credit cards, auto loans and student loans.

How can I improve my credit score?

- Pull your credit report regularly.

- Avoid missed payments.

- Reduce your total debt

- Report rent payments and utilities to build credit.

- Watch your credit utilization.

- Diversify your types of credit.

- Stay below your credit limit.

- Build your credit history.

- Minimize the frequency of new credit applications.

Pull your credit report regularly.

The purpose is to look for incorrect information (incorrect name, address, phone number, and/or other peoples’ information showing up on your report – especially if you have a very common name), and inconsistencies (credit card balance errors, accounts or debts reported as delinquent when they are not, closed accounts that are reported as open, or duplication errors – when accounts or balances show up multiple times on your credit report because there are variations of your name). You should also look for signs of identity theft and fraudulent activity. If any of the above is noted, you’ll want to dispute them with the credit bureaus. The more information you can provide to back up your claim, the easier your resolution will be.

You’re legally allowed one free credit report, per year, from each of the three major credit bureaus. Request it! Review it!Or visit AnnualCreditReport.com to request all three at one time.

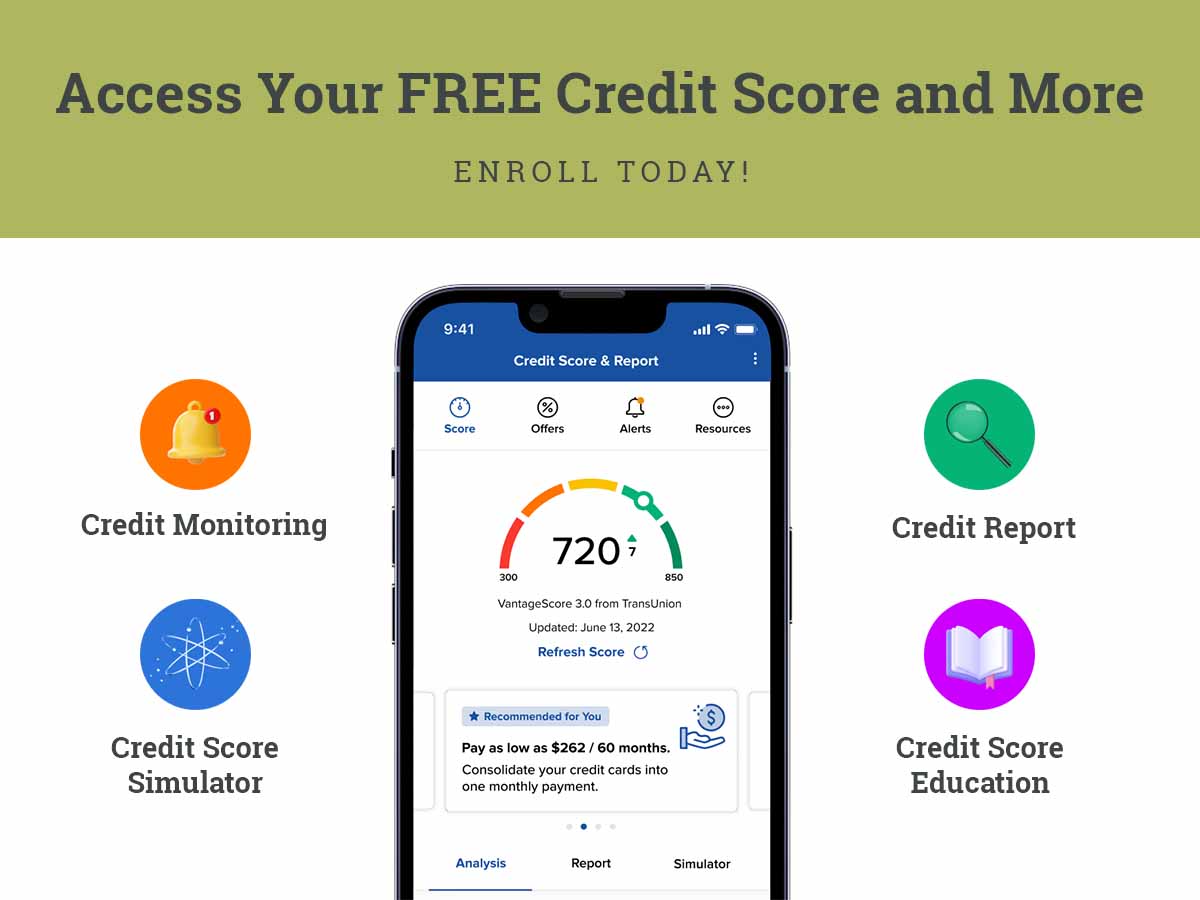

Your free credit score and ‘soft’ report are available through Credit Sense at Prevail Bank. Credit Sense works with the credit bureaus and your creditors. They will challenge the unfair or inaccurate negative items that affect your credit score, ensuring it is up-to-date, accurate, and reflects you honestly. Prevail Bank also offers identity theft protection and restoration services through ID-TheftSmart.

Avoid missed payments.

One of the biggest factors that make up your credit score is your payment history. Make sure you make your monthly payments, in full, and on time. One missed payment could knock 100 points off your score! To eliminate that from happening, set up auto-payments for all credit cards and loans.

Don’t miss another payment. Establish reoccurring automatic bill payments; it’s an option for Prevail Bank customers. Not a Prevail Bank customer? ClickSWITCH will move your accounts and direct deposits to Prevail Bank in minutes. It’s quick, easy, and secure.

Reduce your total debt.

Carrying a lot of debt, especially credit cards, will make it hard to get approved for new cards or other loans. Maxed-out cards or debt that goes over your credit card limits are even bigger issues. Expect negative impacts on your score. Do what you can to reduce it.

Report rent payments and utilities to build credit.

Even if you don’t have loans or credit card accounts, you can still work on building your credit by reporting some of your other payments to the major credit bureaus. The bureaus have programs that allow you to show proof of paying rent and different types of utilities, which will boost your credit score. It demonstrates how reliable you are.

Watch your credit utilization.

Establish utilization alerts so you are aware if your utilization is going up. You want to keep it below 30% (some even suggest at or below 10%).The average person has three (3) credit cards.

Diversify your types of credit.

This isn’t a huge factor, but when lenders see you using credit responsibly in several different ways – credit card loans, student loans, home loans, auto loans, etc. – it gives them a little more peace of mind. But, do not diversify just because you can. Managing your debt and not missing any payments is more important.

Stay below your credit limit.

Another way to improve your credit score is to avoid maxing-out your credit cards or high reoccurring balances. If you are constantly approaching your credit card’s limit, ask for a credit limit increase. The worse they can say is, “no”.

Regain financial control. Credit Sense will get you back on the path to better credit and financial freedom. A comprehensive overview and analysis of your spending patterns and cash flow will be provided, in addition to personalized tips and recommended steps to help you acquire a healthier financial outlook and credit score. It’s a free service provided to Prevail Bank customers.

Build your credit history.

The longer you build your credit history, the better. This gives credit card companies more data to determine how responsible you are – so start early. If you can’t get a standard unsecured credit card because you just don’t qualify for one yet, consider a secured card.

Typically, the minimum credit score for a secured card is much lower. A secured card is a card that you put money down upfront; that money serves as your credit limit ($500 or $1,000). If you don’t pay this card off every month, the bank will pull the money from the upfront cash. It’s their insurance policy.But know, as you regularly make on-time monthly payments, you will eventually be able to apply and qualify for a traditional unsecured credit card because you’ve demonstrated your credit worthiness. The key to success is to not charge more than you can afford to pay off in full each month.

Minimize the frequency of new credit applications.

The first thing a bank does when you apply for credit is a hard pull of your credit history, which will temporarily hurt your credit score. However, if you keep these ’hard’ credit inquiries to one or two over a 12-month period, the impact will be minimal.

What’s can negatively impact my credit score most?

Bankruptcy or letting a debt go to collections is the worse. Bankruptcy can lower your score by as much as 90% and will remain on your record (your credit history) for 7-10 years. Having a debt go to collections will remain on your credit report for 7 years as well. This includes medical bills, payday loans, and unpaid student loans. You want to avoid collections at all costs.

Many people believe paying off an account in collections will remove the negative mark from their credit report. This isn’t true; if you pay an account in collections in full, it will show up on your credit report as ‘paid’, but it won’t disappear. For their own financial protection, many lenders will immediately reject a loan applicant for funding if they find out a previous debt was referred to collections.

If this has happened to you, you aren’t alone. An estimated 1 in 3 Americans have a debt in collections. What can you do? After paying the debt off in full, you can ask the creditor – either the original creditor or debt collector – for a ‘goodwill deletion’. You’ll need to write them a goodwill letter explaining your circumstances and why you would like the debt removed, such as if you’re about to apply for a mortgage.

Missing a payment is next big no-no. You could lose up to half your credit score!

Events that can negatively impact your score are:

![]()

End the denial letters. Credit Sense can assist you. It’s a free financial wellness tool offered to Prevail Bank’s digital banking customers.

If you damaged your credit, the good news is that you can improve it over time. As you dispute errors, pay down debt, make on-time loan repayments and avoid opening credit accounts, you improve and repair your credit. It may take months or even years to bounce back, but if you plan on buying a home, car, or another big-budget item, it’s worth the time and effort.

What should you do first?

Beware of companies that say they can raise your credit score quickly. Be wary of suspicious lenders. As shared earlier, raising your credit score will take months. It’s also more difficult to accomplish when you find yourself in a lower income bracket, but it can be done.

First Step: Start off on the right foot with a financial check-up. Find out where you are. Understand your credit score. Get back on track with Credit Sense.

Prevail Bank’s credit score solution, Credit Sense, empowers you. It provides options specific to you that will impact your financial health and credit score in a positive manner. Credit Sense’s Financial Checkup feature will provide a comprehensive overview of your spending patterns, cash flow, budget allocations, and debt-to-income ratios. Its proven technology provides an educational approach and customized tools to help maintain a healthy score and/or work toward the restoration of your credit.

It provides:

- Insights: into the key factors shaping your credit score.

- Personalized Tips: for enhancing your credit score and financial health.

- Goals: for you to set, track, and achieve that will enhance your financial wellness.

- Your Estimated Savings: if you consolidated, refinanced, or assumed new debt.

- Ways: for you to reduce interest rates, pay off loans and unsecured debit in a timely manner. It will help you budget your money to increase your scores.

- Classes & Resources: that will provide the tools you need to increase your scores and maintain a healthy financial lifestyle.

- A Credit Score Simulator: to evaluate financial options and their impact on your score.

- Reports: anytime, anywhere for a comprehensive understanding of your financial standing.

- 24/7 Monitoring & Notifications: to keep you aware of any changes, suspicious activity, and updates to your credit score.

- Dispute Assistance: to keep your credit history accurate.

In this digital age of data breaches and stolen information, it’s important for all of us to play defense when it comes to our financial lives. Conquer your 2024 financial resolutions!

Embrace the spirit of "A New Year. New Goals. New Score. New You!"

Enroll in Credit Sense.