Posted On: January 18, 2024 by Prevail Bank in: Banking / Money Management

Making New Year's Resolutions?

As you embark on the exciting journey of self-improvement in 2024, consider your financial health. Your credit score defines your financial health and future well-being. Your obtainment of better housing, employment opportunities, and an affordable mortgage and car loan are on the line. A low credit score typically means higher upfront costs, interest rates, and monthly fees.

As an example:

For a $20,000 used car loan, with a five-year term:

A person with a high credit score could expect to pay approximately $371 every month VERSUS roughly $502 for a buyer with a lower credit score.

The buyer with better credit would pay about $2,235 in interest over those five years, while the buyer with lesser credit would pay around $10,147 --- That’s $7,911 MORE for the same car!

Seriously, who has that kind of extra money laying around?! And to make matters worse, in most states, bad credit also means higher car insurance rates too! It’s like pouring salt on an open wound. It just keeps getting worse.

| Car Payment Calculator | |||||

|---|---|---|---|---|---|

| Information provided is for educational purposes only. Accuracy of results below can not be guaranteed. | |||||

| Credit Score | Average APR, Used Car** | Amount Borrowed | Payment Length (Term) | Estimated Monthly Payment* | Total Interest Paid* |

| 760+ | 3.49% | ||||

| 700-760 | 4.25% | $20,000 | 60 months | $370.59 | $2,235.47 |

| 650-700 | 6.50% | ||||

| 600-650 | 10.75% | ||||

| 550-600 | 17.50% | $20,000 | 60 months | $502.44 | $10,146.66 |

| Below 550 | 22.00% | ||||

| *https://www.experian.com/blogs/ask-experian/car-payment-calculator/ | |||||

| **APR Source (Jan 1, 2024): https://www.withclutch.com/faq/what-is-the-average-interest-rate-on-an-auto-loan-with-700-credit | |||||

| APR = Annual Percentage Rate | |||||

So, how can you get ahead? How can you avoid paying these higher interest rates?

By improving your credit score.

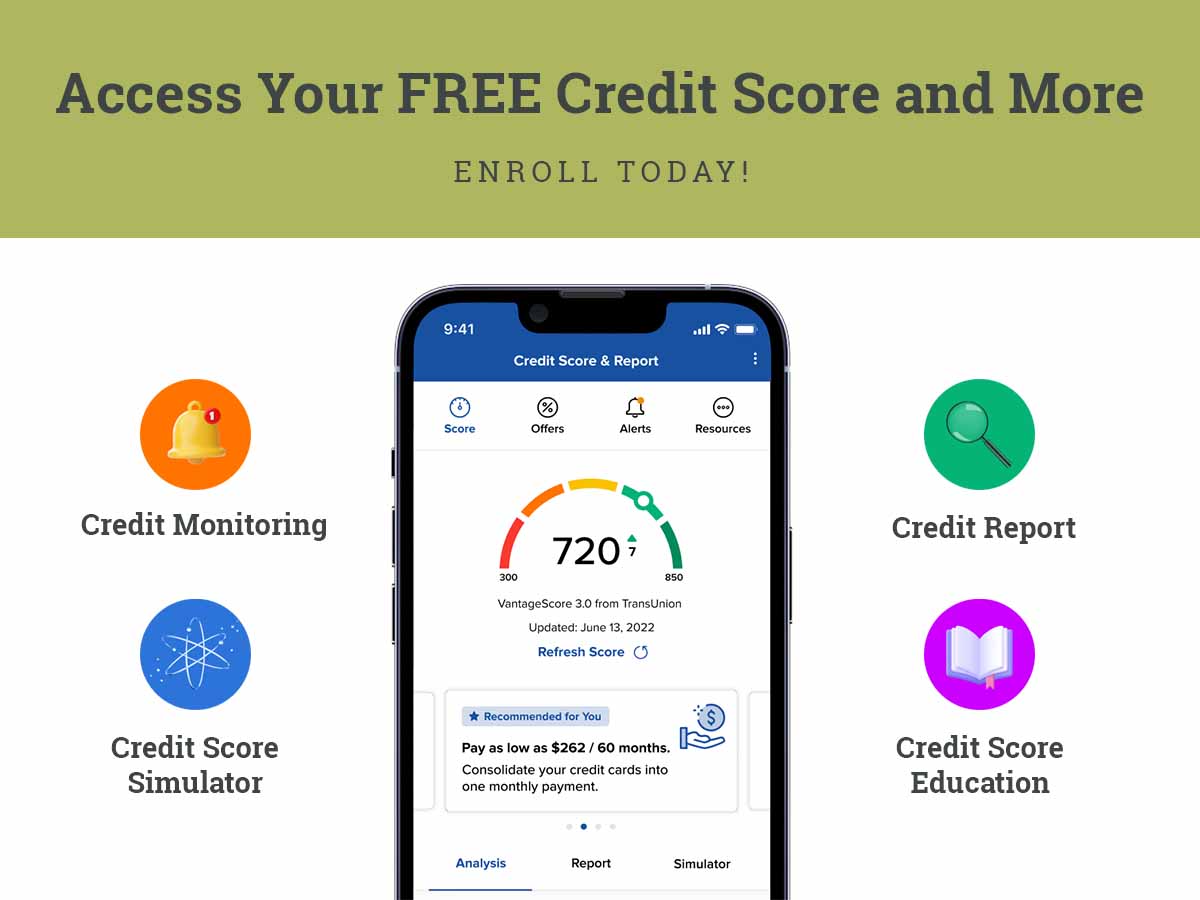

What is a credit score?

Your credit score (commonly called a FICO Score) is often the determining factor when a loan, interest rate, or credit card application is being evaluated. FICO Scores can range from 300 at the low end to 850 at the high end.

Credit scores are maintained by the national credit bureaus (Equifax, Experian, and TransUnion) and include debt like credit cards, auto loans and student loans.

Why is a high credit score important?

A high credit score (a good credit history) shows potential lenders, landlords, employers, and insurers that you have a track record of repaying borrowed money as agreed. The benefits include:

- Easier credit/loan approvals. You can borrow money at better interest rates.

Scores above 740 typically qualify for the lowest mortgage rates and the best car loan rates. The minimum credit score needed for most mortgages is around 620. However, government-backed mortgages, like Federal Housing Administration (FHA) loans, usually have lower credit requirements than conventional fixed-rate loans and adjustable-rate mortgages (ARMs).

Prevail Bank’s mortgage loan originators are known for their creative solutions. They can help you figure out which mortgage options would best fit your situation and lifestyle.

From a car loan perspective, Experian reported in the 3rd quarter of 2023, about 69% of cars financed were for borrowers with credit scores of 661 or higher. Borrowers with scores of 501-600 accounted for about 13%. Even with poor credit, you can find an auto loan for your needs. You’ll need to do a bit more looking to get the best rate. It’s also a blessing to know that lenders will also consider your income, employment history, and your debt-to-income ratio.

- Qualifying for the best credit card deals. You can acquire higher credit card limits.

A strong credit history will help you qualify for the best credit cards, which include low interest rates, rewards, and cash back. A low- or no-interest credit card can also serve as a temporary emergency fund if the need arises.

- Improve your chances of renting a home.

Many landlords will pull your credit report so they can gauge how likely you will pay your rent on time. If your record has too many ‘negatives’, getting that dream apartment may be difficult. It is possible to rent with bad credit, but you can anticipate a higher security deposit and/or a request of a co-signer on the lease.

- Better car and home insurance rates.

Car insurance companies can't turn you down based on your credit, but you're likely to pay higher premiums if your credit score is too low. In most states, blemished credit can also make homeowners insurance and renters insurance more expensive.

- No utility deposits.

Before taking you on as a customer, a utility company might look at your credit report to get a sense of your payment history. If your credit history isn’t ideal, it may require a deposit or ask for a letter of guarantee, in which a friend or family member agrees to pay your bill if you don't.

- Get a job.

Because good credit determines so much of your financial life; loan approvals, interest rates paid, insurance premiums, and security deposits, it’s important to do what you can to help your credit. This is why you should prioritize the health of your finances.

What makes up a credit score?

There are six factors that are directly tied to your credit score.

- Payment history.

Your payment history (how often do you pay your bills on time) is the most important factor. It accounts for about 35% of your credit score.

- Total debt owed.

The amount you owe on loans and credit cards makes up 30% of your score, ranking as the second most important factor. Carrying a lot of debt, especially credit card debt, is a score killer.

- Credit utilization.

Credit utilization is the percentage of available credit you’ve borrowed. This does NOT mean you should max-out your credit cards – No. No. No. Believe it or not, if you consistently use only 10-30% of what your credit cards have prequalified you for, that is the ideal.

Also be aware that a debit card, whether you use it to make a debit or credit transaction, does NOT improve your credit score because it is drawing from your own money (your checking account). You aren’t borrowing money from a lender.

- Length of credit history.

According to MyFICO.com, length of credit history accounts for 15% of your score. The longer the history an individual has of paying their bills on time, the better. That’s why younger people tend to have a lower score than older people.

If you’d like to gauge your financial health compared to others in your age group, use the chart below.The data is from Experian (2022).

| Average Fico Score by Age Group in 2022 | ||

|---|---|---|

| Generation Z (18-25) | 679 | |

| Millennials (26-41) | 687 | |

| Generation X (42-57) | 706 | |

| Baby Boomers (58-76) | 742 | |

| Silent Generation (77+) | 760 | |

- New credit.

New credit refers to how many credit accounts you’ve opened within the past 12 months. You want to keep this to a minimum, because every time you request a loan or complete a credit card application a ‘hard’ credit report is pulled. Hard pulls ding your credit score.

- Credit mix.

Your credit mix is the type of debt you have. There are primarily two: Revolving credit (IE: Credit cards) and Installment loans (IE: Car loans, mortgages, student loans). If you have both types, that is ideal. But of course, you will want to make sure you can make the payments.

Coming soon (Part 2) … How to improve your Credit Score.