Posted On: June 3, 2024 by Prevail Bank in: Digital Banking Fraud

Banks never ask that. Your text may be a scam if…

For many organizations, consumers are given a choice as to how they wish to receive communications. For many that would be texting.

Texting, from a consumer’s point of view, has its benefits; it’s:

- Convenient; you can respond on your time.

- Efficient. Text messages are typically short and to the point.

- Not tied to the internet, but they do rely on phone carrier networks.

- Messages are delivered immediately (unless the phone carrier is having technical difficulties, the network is congested, or there is poor signal strength).

What is cold texting?

Cold texting is when you are contacted by an organization (or an individual claiming to be from an organization) without your prior consent or permission – It is illegal.

If you receive one:

- Report it.

- Block it.

- Delete it.

But, keep in mind…

- IF YOU TEXTED the organization FIRST for some reason, you just provided them with ‘implied consent’. They can now text you legally.

- If you participated in a text-to-join campaign, IE: you typed “JOIN” or “WIN” etc., to an advertised number (that may have been pushed out through a social media post), you just provided consent.

If an organization is legitimate, they should offer you an opt-out or unsubscribe option. The problem is identifying IF the text you received is really from the organization it claims to be.

Your text might be a scam if...

The frequency of spam texting is staggering. According to SlickText, during just the month of March (2024), 19.2 billion spam texts were received by Americans.

With frequencies that high, it’s okay to be a little paranoid (extra careful) when reviewing and responding to your text messages. Question everything!

In general, if you receive a text from someone you don’t know, and it contains a link, it’s likely a scam. Other indications that a text received may be fake or spam, include:

- Irrelevancy. Meaning, you received a text from out of the blue that you have absolutely no connection to or interest.

- Misspellings or poor grammar.

- Provides a phone number that is more than 10 digits.

- Offers you free gifts or rewards. These text messages might say: ‘Congratulations! You won a $500 gift card!’ Or ‘Your account is eligible for a discount.’ Or ‘We owe you a refund.’

- A text that sends you a security code (usually for a digital wallet like PayPal, Zelle, Venmo) that you didn’t ask for.

- A payment request for a package you weren’t expecting, or a link to track the shipment of a package that you didn’t order.

- Claims your billing statement is ready; you should review the charges and send full payment by a certain date to avoid late fees.

- Requires an immediate response; like a family member is in crisis, a government agency or IRS is threatening action against you, or you received a security alert.

- A request to purchase gift cards for a friend/colleague (with the promise of reimbursement) after the card information is emailed to a provided address.

So, what do you do with spam texts?

Unfortunately, you can’t completely stop spam texts. But, you can reduce them.

- Notify your carrier. Forward the spam text you received to 7726.

- Report the sender to the FTC and FCC.

- Block the sender.

- Delete the message.

- If your phone or phone carrier doesn’t offer spam protection services, consider adding a spam-blocking app to your device.

For those texts that you want to confirm their authenticity or truthfulness:

- Contact the organization in question with the phone number that YOU HAVE from your billing statements or from their legitimate website.

- Consider looking up the number that the message was sent from online or do a reverse search.

- Do NOT call the number the text provides. Do NOT click any links the text provides. Do NOT respond in any way. Do not reply STOP.

Banks never ask that.

Slicktext reports that the most popular text scams are those that impersonate a bank. Always be wary of texts asking you to verify or to update your bank account, payment app, or credit card details through a provided link or phone number.

Real banks and payment app texts won’t include links, attachments (especially when you didn’t ask for it) or send urgent warnings asking you to verify information or transfer money to yourself.

Banks will NEVER call, email, or text you to verify your identity, address, or card number. According to the American Bankers Association, they will rarely ask for your account number, PIN, or password during a phone call – and will never ask for a one-time login code either.

However, if YOU CALL the bank, the bank will ask you a few security questions to confirm it is truly you.

At Prevail Bank, verification procedures have been established for every customer call, inbound and outbound. If the security questions can not be answered correctly, you will be asked to visit the closest branch with a valid ID.

Unless YOU called the number on the back of your bank card or credit card, NEVER share, or verify your personal details. Your personal identifiable information (PII) includes your name, address, phone number, card number, account number, PIN, password, or one-time login code. If the person claims to be from your bank, get the caller’s name and advise them that you will call them back using the published phone number from your bank statement.

Michael Hostak, Vice President / Information Security Officer for Prevail Bank says the most secure way to interact with a bank using a mobile device (outside of calling) is by using the bank’s mobile app, downloaded from a qualified app store, and by using multi-factor authentication.

Many Prevail Bank customers have chosen to bank online or through Prevail Bank’s mobile app, because many of the questions and transactions asked of a banking professional, can now be done securely online or through its app.

Bank customers will likely receive a message of some kind if potential fraud was detected --- but even then, a customer should still call the number on the back of their card, or log into the mobile app, and temporarily freeze the bank card or account in question. Do NOT click on any links provided in the message.

Connie Zuleger, Prevail Bank’s Chief Operations Officer, recommends talking to your financial institution regarding the safeguards they have in place for debit card purchases and how you would receive fraud alerts. It’s important to understand how you will be communicated with and what that message might look like, so the messages aren’t ignored or deleted.

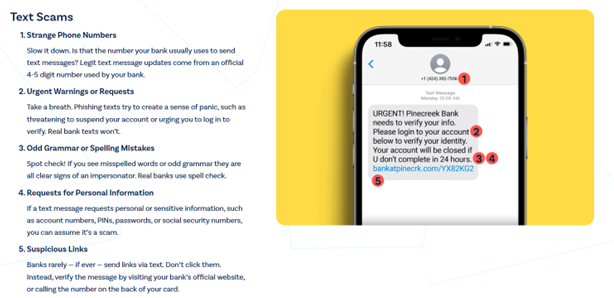

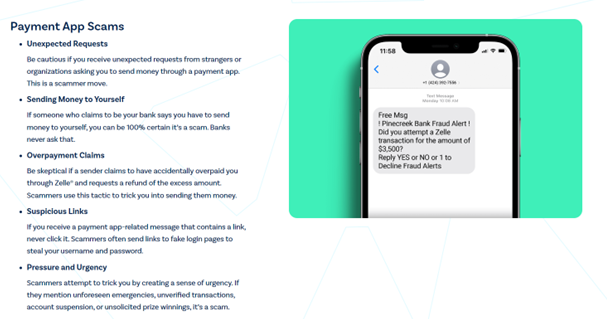

The American Bankers Association (ABA), as part of their national ‘Banks Never Ask That’ campaign produced 5 short and very entertaining must see bank scam videos (including Use your cash for a campfire and Open random stuff from strangers), a Scam City online game, and educational visual examples of what to look for relating to text scams, email scams, payment app scams, and phone scams.

Visual examples below are courtesy of the American Bankers Association

According to the ABA, scammers stole over $8.8 billion from regular people like you and me in 2022. It’s important we get scam smart. Take ABA’s Scam IQ Quiz to test your knowledge.

If you think you fell for a text scam:

- Change your account passwords.

- Contact your bank or credit card company by calling the number on your card.

- If you lost money, file a police report.

Report the scam to the Federal Trade Commission or call 1-877-FTC-HELP (382-4357).

Prevail Bank’s website has a ‘Digital Banking – Digital Security’ blog category that includes articles relating to cybersecurity, impersonation emails, phishing scams, and identity theft protection. Check them out.