Posted On: July 9, 2024 by Prevail Bank in: Banking / Money Management

Adulting 101: Budget, Bank, Credit

Moving out of your parent’s house can be an exciting adventure – whether it be to attend school or to just get out on your own. There are a few things that would be beneficial to establish prior to packing up.

- Establish a Personal Budget

- Make a choice – college, trade school or some other post secondary education, acquire an apprenticeship, get a job, join the military

- Understand how much is pulled from your paycheck for taxes

- Research what your bills will be in addition to rent

- Internet, electricity, phone, garbage, etc.

- Do you have a transportation option? Vehicles can be expensive.

- Insurance, gas, repairs, parking

- What’s left of your paycheck? Budget how much you can spend on groceries, going out to eat, and entertainment – the flexible expenses.

- Establish a Checking Account & Savings Account(s)

- Debit cards vs Credit cards

- Start Establishing a Good Credit Score Rating

All of the above; credit scores, budgeting skills, savings, and investments will play a role in your future achievement of financial milestones --- like taking a Caribbean cruise, buying a house, and/or retiring someday.

Being financially healthy starts with setting and following a budget. Yes, budgeting sounds boring and tedious, but it is truly essential, especially given the economic conditions we have today.

Budgeting is all About Choices

Research says that many 18-24 year olds (Gen Zs) are frustrated with the jobs available today because they don’t cover the ever-increasing cost of living, provide a work-life balance, or align with their personal values. Perhaps that’s why the percentage of 18-24 year olds who aren’t working nor pursuing a higher education is at its highest in the last 4 decades; these young adults are often referred to as ‘disconnected’. Doing nothing is a choice, but it is NOT recommended because the risk factors for lower lifetime earnings, unemployment, and poorer health increase.

Make a choice.

Your career path determines your future happiness and budget. But understand, you will NOT be bound to this choice for all eternity. According to Workplace Insight, if you are a Gen Z (born in the late 1990s and early 2000s), you will likely change careers at least 3x during your life. Interests change; priorities change.

If you chose to jump right into the job market with a high school diploma, Indeed.com says the types of jobs you can pursue include security guard, receptionist, sales representative, mail carrier, driver, and equipment operator. Those individuals without a high school diploma can pursue a position as a plant nursery worker, landscaping professional, barista, grocery store clerk, restaurant server, and housekeeper – to name a few.

Education or training beyond high school is typically necessary if you want to secure a job that meets your criteria and interests. But don’t panic; this doesn’t have to mean a 4-year college degree. Choices include:

- The traditional 4-year college education. Yes, there is growing skepticism relating to the value of a 4-year college degree because of the ever-increasing college costs associated with it and the student debt that’s typically incurred. But for some dream jobs, this educational path is required.

Many careers do not require a 4-year college education. Click here for a list of 25 jobs that pay $50K+ without a 4-year degree. These positions may require instead:

- Trade school, a technical college, community college, or some other postsecondary education courses. These options are significantly cheaper than a traditional 4-year degree. For some positions you can attend school for just 6 months, acquire a Certification, and land a good paying job. Or, consider a 24 month program and achieve an Associate’s Degree.

- If you are considering a short-term schooling option of 6-24 months, seriously consider living at home during this timeframe, because the cost savings to you should be substantial. Of course, your parents may require you to be financially responsible for some items now (your cell phone, clothing, entertainment expenses) or to split the bigger expenses (car payment, car insurance, vehicle maintenance) but it still beats paying 100% of these expenses, plus rent, apartment furnishings, apartment utilities, rental insurance, food … It adds up!

If you are worried about the expense of attending college and student debt, pursue a field that pays you while you learn, offers loan forgiveness, or a company that reimburses tuition.

- An apprenticeship may be your ideal choice. A registered apprenticeship is a career pathway where employers instruct their future workforce themselves. Registered apprenticeships are paid jobs that pay family-sustaining wages. You’ll receive progressive wage increases as your skills develop, classroom instruction, and a nationally recognized credential.

- Consider the US military or National Guard. Many military branches will provide you with advanced individual training (after basic training) to learn the skills needed to perform a specific job. Many of these skills are transferrable to the workplace. Every branch offers a tuition assistance program as well, and anyone that serves on active duty with 36 months of active service qualifies for the Post 9/11 G.I. Bill. (These are 2 separate programs.) The G.I. Bill is provided to all active members regardless of branch; tuition assistance differs between branches, talk to a local recruiter to learn more.

Estimate & Compare Future Career Earnings

If you need help making a choice, consider Junior Achievement’s JA Afford Your Future website. The website offers a career interest inventory assessment tool that will match your interests and talents with careers. Careers expected to have lots of employment opportunity (rapid growth) are highlighted through its career explorer tab, and if you want to maximize your future earnings and minimize your educational debt, the options calculator is a must do. The calculator shows how different choices (career, educational venues, and funding options) can affect your wallet.

Gross Pay vs Net Pay – How Taxes Affect Your Paycheck

Income is an important part of any budget. You may have just been offered a job; you’re excited! But what you are offered as a salary or hourly wage is NOT what you will receive in your paycheck. There is a difference between gross pay and net pay. Gross pay is earned wages BEFORE payroll deductions and taxes. Net pay is what you actually receive to pay your rent, utilities, vehicle expenses, etc.

The deductions you can expect from your paycheck would be federal taxes, state taxes, and social security. For some organizations, a contribution to a retirement fund may also be mandatory. Other optional deductions include health insurance, life insurance, retirement savings, among others. The cost of these options varies between employers.

So, how much money is actually taken out?

If you have a $20/hour, 40 hours a week, position --- that equates to: $41,600 gross / year.

If you live and work in the state of Wisconsin (tax amounts change based on the state you live and work), and if you chose the standard deduction of “1” (assuming you are single) on the W-4 tax form that every employer will ask you to complete, you can expect the following:

- Federal income tax: 7.48%

- State income tax: 2.94%

- Local Income tax: 0.00%

- FICA/ Social Security: 7.65%

You are left with: 81.93% of your paycheck

Which means:

- If you are paid every 2 weeks, gross wages would be: $1,600

- Estimated net wages (what you get to take home) is: $1,311

Nearly a $300 difference, and this is BEFORE any of the optional deductions offered to you!

SIDE NOTE: If your parent(s) included you in their job-based health insurance plan, generally speaking according to healthcare.gov, you can stay on that plan (assuming you’re still living in the same state as your parent(s)) until you turn 26, even if you:

- Get married

- Have or adopt a child

- Start or leave school

- Live in or out of your parent’s home

- Aren’t claimed as a tax dependent

- Turn down an offer of job-based coverage

Of course, a parent doesn’t have to cover you or include you on their health insurance plan. It’s a choice. But if they agree to do so and won’t charge the incremental premium expense back to you, you should come out ahead from a cost perspective. As a safe guard, be sure to check with the employer and the plan; some states and plans have different rules.

I. Establish a Personal Budget

Why Does a Person Budget? Because it:

- Identifies how much money you have to spend.

- Puts you in control. You decide how you want to spend your money.

- Provides direction as to how you’ll spend money in the future.

- Helps prevent impulse spending.

- Will help keep you out of financial trouble.

- Effective money management depends on it.

It is important to be realistic. When you’re first starting out or still attending school, your budget typically doesn’t include a lot of funds for fun. It’ll be tight, BUT this is only for a short time. Once you graduate and land a career position, you should be able to adjust your budget accordingly based on your new income(s).

Steps to Set Up a Budget:

- Estimate your income.

- Identify the amount you’ll put in savings. Pay yourself first. Your savings should not be considered an expense; it’s money you’re putting aside for your future. It shouldn’t be used to pay bills. These funds should be taken out BEFORE you do your monthly budget.

- What are your financial goals (save for college, save for a new/used car, attend a concert, retirement?) Many budget experts recommend 5-10% of your pay going to your savings account. So, if your take home pay is $1300, set up an automatic deposit with your employer to put $65-$130 (5-10%) into your savings account.

- As it relates to retirement savings, consider waiting until you are out of school and working fulltime. THEN, pull an additional 5-10% out from your pay. Take advantage of any matching funds your employer is willing to pay. Meaning, if your employer says they will match the first 3% of your retirement funds, then that is the minimum you should consider (3%), because their additional 3% means a total of 6% is going into your retirement fund for your future. If you can afford to put more into your retirement fund, great!

- And what about the unexpected? No one plans to be in an accident or losing their job. Do you have the funds to keep you afloat? This is where an emergency fund (another savings account) is needed. The experts say you should have 3-6 months’ worth of funds in an emergency fund that could cover all of your expenses for that length of time. Anything is better than nothing, start saving today. Consider putting aside an additional 2-5% ($26-$65) from every paycheck into an emergency account.

Now that you’ve identified and pulled out the amounts you want placed into savings, the rest can be deposited into a checking account to pay bills.

- Estimate your monthly expenses. They should include:

- Fixed expenses (the same dollar amount will be expensed every month).

- Rent, renters insurance, internet, cell phone, garbage pickup, existing loan payments, broadcast TV, streaming services

- Vehicle expenses

- Fixed: car payment, car insurance

- Flexible expenses: gas, maintenance & repairs, oil changes, parking

- Flexible expenses (these expenses change month to month).

- Food, electricity (utilities), water, bus fare/carpool share, clothing, personal items, hair appointments, school expenses, medical expenses, household items (garbage bags, cleaning solutions, bed sheets…), tuition, entertainment, gym memberships, credit card debts, pet supplies/food.

- Fixed expenses (the same dollar amount will be expensed every month).

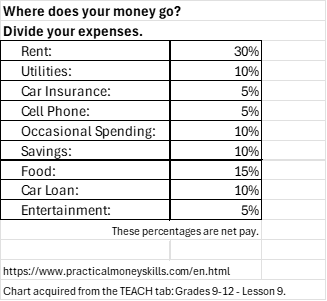

According to VISA’s Practical Money Skills, the chart below provides a sense of how to allocate your money for different expenses. Adjustments may be made based on your preferences. As an example, if you want more money for entertainment, can you afford to cut back on another expense to afford it?

Vehicles can be expensive.

If you’re able to bike, walk, use public transportation, or car pool with someone who has a vehicle to/from work and school, that is recommended when you’re first starting out on your own, because it is significantly cheaper. If you own a car, you’re most likely making a monthly car payment, then there is insurance (collision, comprehensive, and uninsured motorist), gas, oil/oil changes, parking/tolls, tickets, annual registration/license tab fees, new tires every other year, other maintenance, breakdowns, and accidents. These are all expenses you’ll need to budget if you have a car or truck. Vehicles don’t go up in value; they go down. They can be very expensive to own.

- Do the math. Compare your estimated expenses (the total) to your available income. Are you spending more than you are making? If so, adjust. Reduce your expenditures.

- Now, start tracking. Keep a record of everything you buy. Tally and list those totals next to the budget totals estimated in Step 3. A couple budget worksheet options that you might find helpful are linked here.

- Junior Achievement - Sample Budget

- VISA Practical Money Skills

- Budget Worksheet (PDF)

- Next Generation Personal Finance – Salary Based Budgeting Worksheet (Excel) - After opening (click the Excel link open), choose File ® Make a Copy. Name your worksheet. Close the original Salary-Based Budgeting Worksheet. Use your copy of the worksheet to record your numbers.

- Federal Trade Commission – Make a Budget Worksheet (PDF)

- NerdWallet – How does your spending compare to the 50/30/20 budget? (50% of your budget is spent on essentials, 20% is put toward savings and investments, 30% covers the nonessentials (travel, eating out, shopping).)

- Microsoft Office Excel Budget templates – Visit templates.office.com and type ‘Budgets” in the search box.

- Rebalance your budget continuously.

- Each month, compare your income to your expenses; compare what you spent to what you budgeted. Continually rework your budget until your income is greater than your expenses. Continue to track and compare. If you find yourself with a surplus, consider increasing the amount you save (Step 2) so you’re able to fulfill your goals sooner.

- It is likely some ‘wants’ may need to be curtailed and an additional income source identified until happier financial times are upon you. Some things you could consider would be: Delete the $4 coffee purchases, make & bring lunch from home rather than eating out, shop only sale items, reduce the number of classes taken every semester, consider a roommate to help pay the rent and utilities, consider an additional parttime job, apply for more scholarships…

- It is likely that some items considered as ‘needs’, may be recategorized as ‘wants’ and temporarily deleted from the budget, IE: streaming services, gym memberships, the car …

As your finances change (you receive a raise, a baby is expected…), be sure to adjust your budget.

Tips for Maintaining a Budget:

- Learn how to get the most for your money. Shop the deals.

- Give yourself a weekly allowance for the flexible ‘wants’ IE: for personal items, clothing, and entertainment expenses. When the money is gone, you go without.

- Exercise willpower and self-control. Do not indulge in unnecessary spending.

- Develop a good record-keeping system.

- Evaluate your budget regularly.

- Consider the 50/30/20 budget guide for money management: 50% of your budget is spent on essentials, 20% is put toward savings and investments, 30% covers the nonessentials (travel, eating out, shopping).

II. Set up a Checking and Savings Account(s)

Prior to moving out of the house, establish yourself with a checking account and possibly two savings accounts; one for your financial goals, and the other as your emergency fund for the unforeseen expenses.

To make this happen, you’ll have two decisions to make:

- Which bank or financial institution do you want to work with, and

- Which checking account option do you open?

Which Bank or Financial Institution?

When making your decision, take into consideration if the organization has:

- An exceptionally secure online and mobile banking solution. Do some quick research; have there been any hacks or negative reviews published.

Security is a high priority at Prevail Bank. Prevail Bank’s digital banking platform incorporates what is called a real-time, risk decisioning engine that integrates five (5) other security programs into one gigantic cybersecurity platform! We have essentially SIX cyber security platforms constantly monitoring, assessing, and blocking threats for our customer’s benefit.

- Are the professionals friendly, helpful, knowledgeable, and accessible when you call or stop in? When the time comes to acquire a mortgage, would this institution be able to help you? Does this organization offer commercial loans, electronic fund transfers (ACH services), a secure online payroll platform, and business advisors (just in case you decide to open your own business)? ---- Of course, you don’t have to use the same banking institution for everything, but it tends to be more convenient if you do. Those banks that have actual branches (with real people, not just a voice over a phone) could easily become a trusted financial advisor, a professional, who would ‘go the extra mile’ to help you.

- Compare fees!! What’s free? Typically, the bigger the bank the more fees and less forgiving they are. Be especially aware of overdraft fees, minimum balance fees, statement fees, debit card fees, and maintenance fees.

- If money management is new for you, consider overdraft protection. Overdraft protection is an agreement with your bank that they may cover the amount of a purchase, ATM withdrawal, or a wire transfer that accidentally dips below what you had in your account. This service typically involves a fee and is generally limited to a preset amount. This is good to have, because otherwise your ‘bad’ check or payment will be returned to whomever you made the purchase through, possibly resulting in additional fees, penalties, and a dip in your credit score. Institutions differ when it comes to overdraft protection; you will want to compare.

- ATM availability – better yet FREE (no fees) ATM availability.

- Are there minimum balance requirements to worry about?

Which Checking Account option?

There are so many checking accounts out there to consider – free checking, checking accounts that pay you cash back when you use their debit card, checking accounts that earn interest on the balances you keep …. How do you know which one is right for you?

Well, if you were considering the three options listed, checking accounts that pay you cash back or earn you interest have minimum requirements that you must adhere to for the benefit advertised. Like:

- Will you make 10** or more debit card purchases a month?

- If you think you will ----- Do you think you’ll have at least $1,500** or more in this account, all the time?

- If so, then a checking account that pays you interest on that balance may be the best choice for you. NOTE: The amount of interest differs between institutions too. So, if this account type is right for you – Shop around.

- If you think you will ---- BUT you DON’T plan to have $1,500** or more in the account every day of the year, then a cash back checking account may be your best choice.

- If you think you will ----- Do you think you’ll have at least $1,500** or more in this account, all the time?

- If you DON’T anticipate using your debit card 10** or more times during a month, then a ‘Free’ checking account type, the most basic option, would most likely be best. Keep in mind that a free account typically means you won’t be charged a monthly service fee, but all the other fees still apply. You’ll want to ask, what exactly does ‘Free’ mean and which fees still apply.

**The numbers, 10 and $1,500, were randomly chosen to illustrate what some requirements might be.

The above is an over-simplification of the type of checking accounts out there. The requirements to qualify for the different checking account options do vary between financial institutions; they may be more extensive than what is illustrated above, fees may be involved as well. You’ll want to compare. But again, if you’re just starting out, the basic checking account option is most likely for you. Know and understand what the minimum requirements are and the fees you could incur if you don’t fulfill them (the requirements) on a continual basis.

Prevail Bank’s checking accounts all come with a FREE debit card, FREE online banking, FREE bill pay, FREE mobile banking with mobile deposit, FREE eStatements, and FREE credit monitoring with Credit Sense. There are NO minimum balances required and NO monthly service fees.

If you are a customer of another banking institution and want to switch, Prevail Bank’s secure ClickSwitch software makes it easy.

Once you’ve decided with whom you want to open a checking account and you’ve chosen the checking account that is right for you, work with the same institution to establish two savings accounts (as suggested in ‘Establish a Personal Budget’ step #2); one that will fulfill your future financial plans and the other as an emergency fund.

The banking professional you are working with should be able to recommend the right saving account(s) for you to open. You want your savings accounts and checking account with the same organization because transferring funds between accounts is easier.

Improve your financial health. Save money – automatically and a consolidated list of money management tips are Prevail Bank blogs offering money saving considerations. Check them out.

Debit Cards vs Credit Cards

Debit cards essentially replaced the hand-written checks that used to be written for groceries and utility bills. Most checking accounts come with a debit card. (Be sure to ask if there are fees associated with debit card usage. If you’re being charged, consider a different institution.) When you use your debit card to purchase something, the funds you spent for that purchase are immediately reflected – meaning, your checking account balance is immediately reduced.

SIDE NOTE: If you aren’t careful, you could easily deplete your checking account because the debit card is so easy to use. (This is when you’ll be charged overdraft fees.) It is highly recommended that you ‘turn on’ all the fraud and usage alerts associated with your debit card. Those alerts will tell you if/when your balance is running low, among other things. If your institution doesn’t have mobile ‘alerts’ for your debit card, consider a different institution.

A credit card is basically a loan. Your purchases are totaled up for a month’s time and a bill sent to you for payment. The credit card company will have a minimum amount noted that they will accept as payment on the bill, BUT anything not paid is accumulating interest at a very high rate. Best practice is to pay the full amount of all the expenses on that card every month. If you can’t pay the card off 100% every month, you should stop using it. Like the debit card, it can get you into financial trouble easily and quickly.

As a person just starting out, one credit card, that does NOT have an annual fee, to use for emergency purposes or the occasional purchase (that you know you can payoff at the end of the month) is recommended. For example, a credit card is required if you find yourself without transportation and need to rent a car; it’s also needed to reserve a hotel room. Credit cards build up your credit score rating; debit cards do not.

SIDE NOTE: Credit cards can hurt your credit score rating too; if you max out your credit card, if you spend more than your credit card limit, if you miss a payment, or if you are late making a payment. Don’t do it! Pay on time, all the time.

III. Start Establishing a Good Credit Score Rating

Having a good (high) credit score is essential, whether you’re renting an apartment or opening a new credit card. A credit score is a rating that financial institutions, landlords, and lenders look at to determine how likely you are to pay off your debts and obligations. Your FICO credit score, ranges between 300 to 850, and is determined by five factors:

- Your payment history is the most important. Do you pay on time?

- How much do you owe compared to how much you can actually borrow is the 2nd most important. (Incidentally, having a lot of debt, especially credit card debt, is a score killer. Believe it or not, if you consistently use only 10-30% of what your credit cards have prequalified you for, that is the ideal.)

- The length of your credit history – the longer the better.

- New credit – how often do you apply for and open new accounts.

- And your credit mix is the 5th factor. Lenders like to see variety, IE: credit cards, installment loans, finance company accounts, mortgage loans…

There are ways to start building your credit.

- Ask your parents to add you as an authorized user for one of their credit cards. You don’t have to make any purchases on their card to reap the benefits of their payback practices, assuming they have good credit habits. And the sooner you are able to establish this, the sooner your credit history begins.

Best practice is to pay off a credit card in full every month. Do not pay the minimums because the interest rate is too high to bear for any length of time. If you can’t pay off your credit card(s) every month, you need to reduce/stop using them.

- Open a secured card. Getting a secured card doesn’t require a credit history, but you do have to put down a security deposit, usually equal to the amount of the monthly credit limit (usually around $200). The security deposit is collateral, in case you don’t pay. If you make all of your credit payments, you’ll get the initial deposit back, in addition to building a good credit score.

Prevail Bank has additional blogs relating to Credit Scores: Why it’s important, How can you improve it, among many others. Prevail Bank also offers its customers a free credit score solution called Credit Sense. It provides options that are specific to each customer that will impact their financial health and credit score in a positive manner. It includes an overview of spending patterns, cash flow, and debt-to-income ratios.

In Conclusion

Getting out on your own and living independently is exciting, but it is recommended to have some financial resources lined-up first --- a personalized budget, a checking account, saving accounts, and a start on a good credit score rating.

Be wary from whom you get your financial advice. According to CNBC Select, Paxful, a cryptocurrency trading platform, found 1 in 7 videos that talked about the merits of investing in cryptocurrency and/or how some people were able to pay off all their debts without any difficulty were misleading. The majority of these videos were FinToks – people talking about personal finance on TikTok.

And, if you think you’re a savvy money manager already, consider playing PlayMoneySmart.fdic.gov. This website offers 14 games that are mobile friendly. They’re related to income & expenses, spending & saving, borrowing, using credit cards, buying a home, financial disasters, protecting your identity, and others.

The decisions you make now will shape your financial future for years to come. Plan to succeed.

Prevail Bank offers 1:1 assistance when it comes to personal or business banking needs. We offer home loans, mortgages, commercial loans, business resources, and guidance. Contact a Prevail Bank banker at any one of our 9 central Wisconsin locations, Monday-Friday, 9am-5pm. 800-205-0914